Time in the market vs. Timing the market

“Psychologists and behavioural economists have found that as humans we tend to feel a loss about twice as severely as we experience a gain”. We tend to panic about bad stuff while it is happening and think that it will last longer and be more destructive than usually the case. It is a behavioural error we all make. Later, we regain perspective and realise the bad stuff wasn’t that bad after all.

The same behaviour can be applied to how we think about investments, where our natural inclination is to assume that markets will never recover and that the most prudent action is to sell our investments and remove ourselves from the ‘downturn’.

It is times like these that we need to take a step back and look at the whole picture. There is a reason as to why you invested originally, and that reason still applies despite this recent sell off.

What does history teach us?

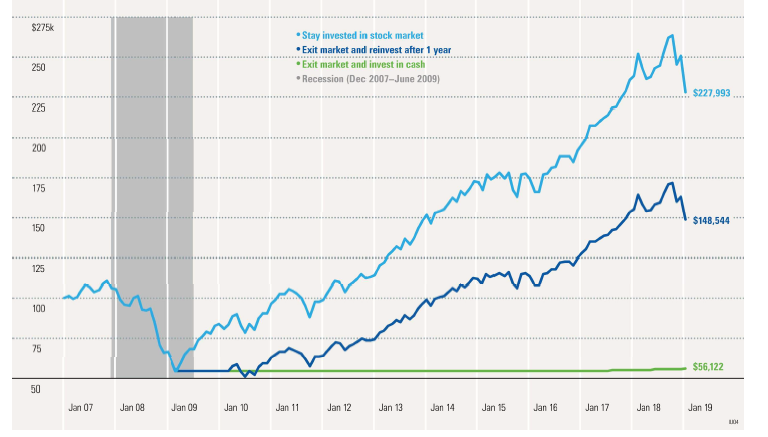

We have seen this before in 2008. When markets sell off it is very difficult to see the light in the future, but history teaches us that selling investments during market drops is the worst possible decision. The market rallies that come after a drop end up making those falls that seemed so stark a small blip in your long term investment. Recoveries come quickly and, by the time most people spot them and try to put their money back in, the biggest gains have usually already been missed. The graph below, by Morningstar Investment Managers illustrates the different approaches taken in 2008 and the result of these. Those that remained invested had greater gains.

Timing the market

This comes back to the investment mantra ‘time in the market or timing the markets’. What is difficult at these times is not only resisting the emotion to sell but also the inclination to think that you can time the markets, selling now in the hope of avoiding any further downturn and then re-investing to catch the upside. Again, history shows us that spending time out of the market usually backfires and ends up crystallising more losses as the market recovery comes swiftly and those on the side-lines are left behind.

Time in the market

Instead of trying to time the market, we believe that spending time in the market is more likely to give you good returns over the long term. Of course, this means experiencing the bad days as well as the good days, but markets and wider economies have a tendency to go up over time. This applies to everything from share prices to the price of goods.

We started this message talking about why your monies were invested in the first place, which is to reach your long term objective, whatever that may be. Successful investing requires patience, it is for exactly the conditions we are seeing now, to ensure that shorter term falls are smoothed out over a long term period and your investment goals are met commensurate with your risk level

Unless you have a cash need that was unforeseen when your original investment was made, taking money out now will ensure that your objective is not met, but by trusting the original process that led you to the investment in the first place, you can give yourself the best opportunity of still meeting that original objective and avoiding the emotional reaction that can damage your long term potential returns.

Trust your financial adviser

The reason you trusted your Financial Adviser in the first place is to help guide you through times such as these. It is worth remembering during these times that, much like we are listening to the advice of professionals as to how to deal with the Coronavirus, Financial Advisers and Investment Managers have the experience and knowledge to guide and advise you through these moments to ensure that you do not make decisions that you regret with the benefit of hindsight.